How the Devin Framework Works

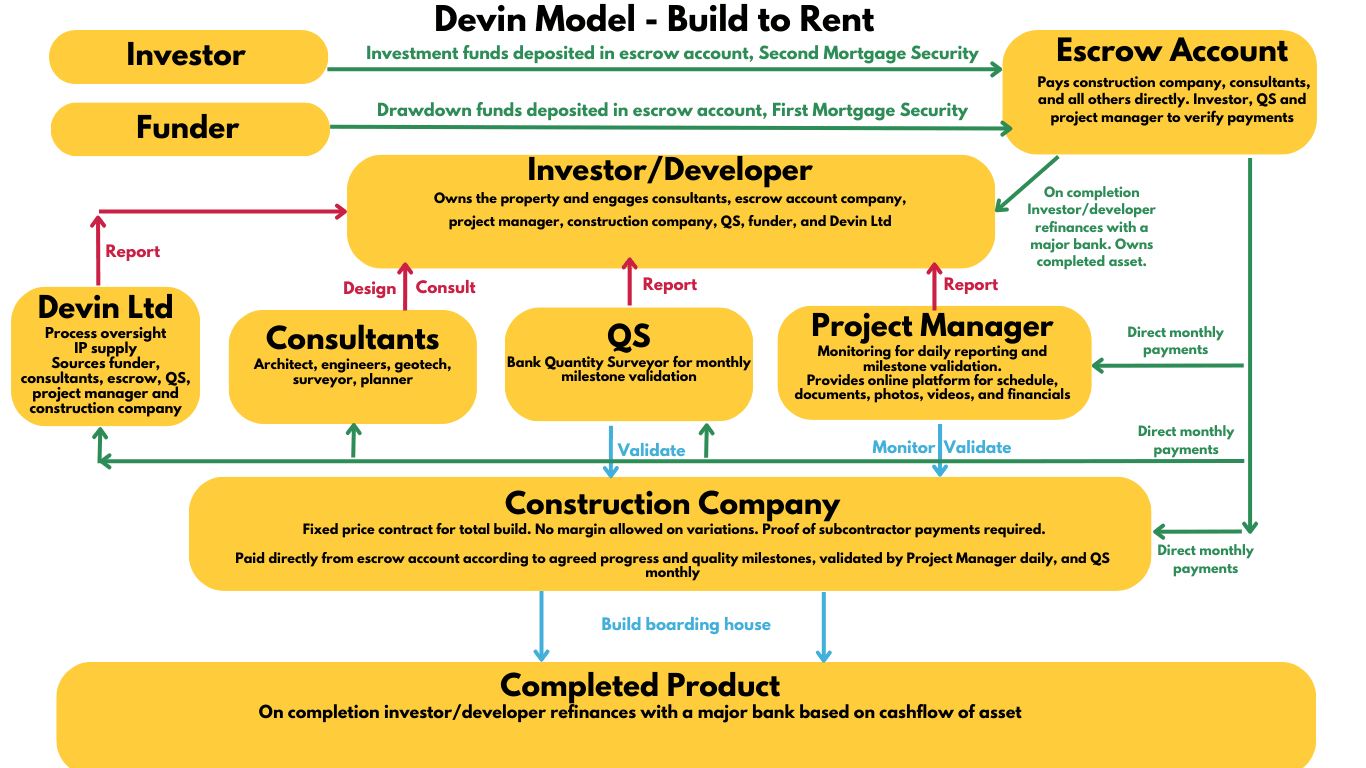

Traditional development often concentrates decision-making, validation, and capital control in too few hands. The Devin Framework restructures this by separating roles and placing payment release behind independent validation.

Investors benefit from:

Full capital control at all times

Independent validation of every payment

No exposure to developer insolvency or mismanagement

Strong refinancing opportunities on completion to recover invested capital

Ongoing ownership of a stabilised Build-to-Rent asset

This is not speculative development.

It is governed capital deployment.

How the Devin Model Works

Capital discipline

Investor SPV provides equity (typically project-specific)

Funder provides debt funding (project-specific)

Drawdowns and equity are held in independent escrow

Escrow payments are released only against validated milestones

Validation is performed by the QS and Project Manager, with Owner approval

Triple signatory authorisation is mandatory:

Investor

Independent Quantity Surveyor (QS)

Independent Project Manager

No single party can move capital unilaterally.

Independent Validation at Every Stage

Each phase of the project is delivered and validated independently:

Consultant Group

Design, Resource Consent, Building Consent, EPAConstruction Company

Fixed-price contract, no margin on variationsProject Manager

Daily oversight, documentation, progress verificationQuantity Surveyor

Monthly financial and construction validation

Payments are released only when all validations align.

Fixed-Price Construction with Aligned Incentives

Proven construction partners

Fixed-price contracts

No margin or management fee on variations

Proof of subcontractor payment required before drawdowns

This structure removes the incentive for cost overruns and delays

Completion, Refinance, and Capital Return

Upon completion:

Upon completion, the investor may choose to refinance based on independent valuation and lender terms. Outcomes depend on project-specific costs, programme, market conditions, and funding terms

The result:

A stabilised Build-to-Rent property

Institutional-grade governance

Ongoing cashflow

No capital remaining at risk

What Devin Ltd Does (and Does Not Do)

Devin Ltd is not a developer and does not take construction risk.

Devin provides:

Framework licence and documentation architecture

Process compliance review and structured reporting requirements

Introduction of qualified service provider options (Owner appoints)

Devin does not:

Hold funds or control escrow

Sign off milestones or certify works

Act as project manager or construction supervisor

Provide legal/financial advice

Guarantee outcome

This separation is deliberate and central to investor protection

Important Notice:

Devin provides a governance framework and process architecture. This website is not an investment offer or financial product disclosure. No outcomes are guaranteed. Prospective participants must obtain independent legal, financial, and tax advice.